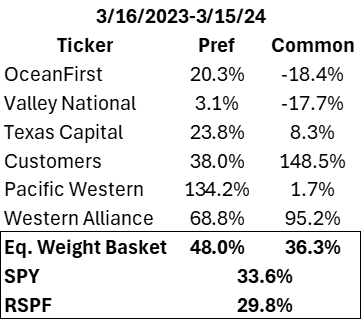

Here goes my first post-mortem. First, did the trade work since my post1?

The pref basket performed best, but any equal weighted basket of these names beat SPY & RSPF over a 1 year holding period. PACWP drove outperformance thanks to a better merger conversion rate than common shares.

So, the thesis worked: no banks with immediate insider purchases went under & their prefs saw equity like returns. However, I made A LOT of process mistakes:

Research Quality

Listening to Bill’s pod with Maxfield the other day was eye opening. He claims there are 4,000 existing US banks & 17,000 failures since the start of the US. I never knew that survival is the exception not the rule. I should have thought to find US bank failure rates.

The bull case wasn’t well researched either.

“In early 1991, Powell found himself at the center of a disaster involving the Bank of New England, a large regional bank on the brink of failure as a result of the recent collapse of the commercial and residential real estate markets…the Bank of New England was only the 33rd largest bank in the country…A fraction of the $19 bn in deposits at the bank and two of its sisters were in accounts that exceeded the amounts guaranteed by the Federal Deposit Insurance Corporation. Should the government let market forces wash away poorly managed institutions? Or did it have a responsibility to prevent shocks to the bigger economy?

Robert Glauber, a Harvard academic whom Powell reported to, came down firmly on one side: he hated bailouts…If we always run to the rescue, he said, it creates a “moral hazard.”

After Glauber got off his soapbox, LaWare calmly laid out the Fed’s line: “You’re the government, and you can do whatever you want, but here’s what we think will happen if we haircut uninsured depositors. There will be a run on every American bank when they open Monday, and all these money-center banks will be at our door. Do you really want to run that test, Bob?”

“We chose the first option, without dissent,” Powell said.

A few months later, Powell again wrestled with the problem of what to do with a financial institution on the verge of insolvency. [He was the direct negotiator with Buffett in Solomon Brother’s restructuring]. Powell was finally able to exhale [upon finalizing a deal]. “The firm’s failure,” he said years later, “would almost certainly have caused massive disruption in the markets.”

These two examples were within page 16 of Trillion Dollar Triage. Not hard to find.

The thesis relied on the banks not failing and I never thought to find profiles or books on Powell. Let alone an insider exclusive. I easily could have researched smarter.

Sizing

Here is how I sized the trade at cost:

So much for “I’m not interested in racing insiders to find the bottom in their shares…I think that with proper sizing a basket of these prefs can’t be ignored” - me. I’m unlearning the wrong lessons I internalized by having a crazy year in 2021 being 80%+ invested in BTC miners. Luckily, I’m unlearning it without giving up all those profits.

Fascinatingly, going back and calculating my PnL forced me to realize I remember losing way more money than 4% of book. I can clearly see effect on my mental in my daily journal entries and it’s clear the tilt mindset definitely continued in throughout this year which did have major PnL consequences. It’s been almost 2 years since the trade, and I think I’m finally getting “un-tilted.”

I anchored to the drawdown number, not the actual realized PnL and let it affect my future decisions. I should also be doing these postmortems way sooner. Very irresponsible to have waited this long to face this.

I also didn’t consider the chance of anything going wrong. There was a bad Bloomberg article on PACW’s solvency that led to a 50% gap down. The deposits had stabilized, but the mere article being posted changed things because now people might run the bank again. The volatility in over 50% of my book led to me being shaken out of a winning trade.

All this resulted in significant underperformance compared to holding the basket for one year:

A terribly executed trade, no sugarcoating it.

So how do I improve in the future?

Keep eyes on Key Drivers. The only 3 main KDs for the year were deposit losses, reinstated pref dividends, and fed intervention. This article answered the divs being reinstated, the insiders signaled on the deposits, and researching Powell would have answered the 3rd KD. I did a good job of noticing the thesis shifting when the bad BBG story ran, but I never tried to answer the shift in KD focus.

Bull/bear tension. You don’t know what you don’t know, and you especially don’t know to answer Qs you never had. I should have been directly talking with people getting them to tell me why I’m wrong to better my odds of having complete information to make a decision. S

Understanding risk. I never estimated risk which is a problem since sizing should be based on risk. I could estimate risk through the options implied volatility or since the downside was 0, sizing as if the names go to 0. This would normally be a 2% individual sizing, but since there was so much obvious correlation of bank run risk, it would maybe be 1% per name since there’s 6. Arguably until a fed program was announced the risk prohibited any sizing more than 2% of book.

Finally, I just have to laugh at the terrible timing. I was walking El Camino with some broken tennis shoes and my school backpack the week of the bad BBG story. I sold a lot of my positions upon seeing the reaction to the article which I don’t think was a terrible decision, but I never got back “on top” of the trade afterwards. I need to be constantly re-evaluating.

Footnote about PACWP returns: I do not have data on pref dividends so I may be understating the return. The prefs were converted 1:1 to BANC prefs while the common was converted 1:0.6569 BANC common shares. That return may also be understated if the data I used for PAC common is incorrect (source) and if there were dividend payments made before the BANC conversion. For all returns I assume no reinvestment of dividends paid out.